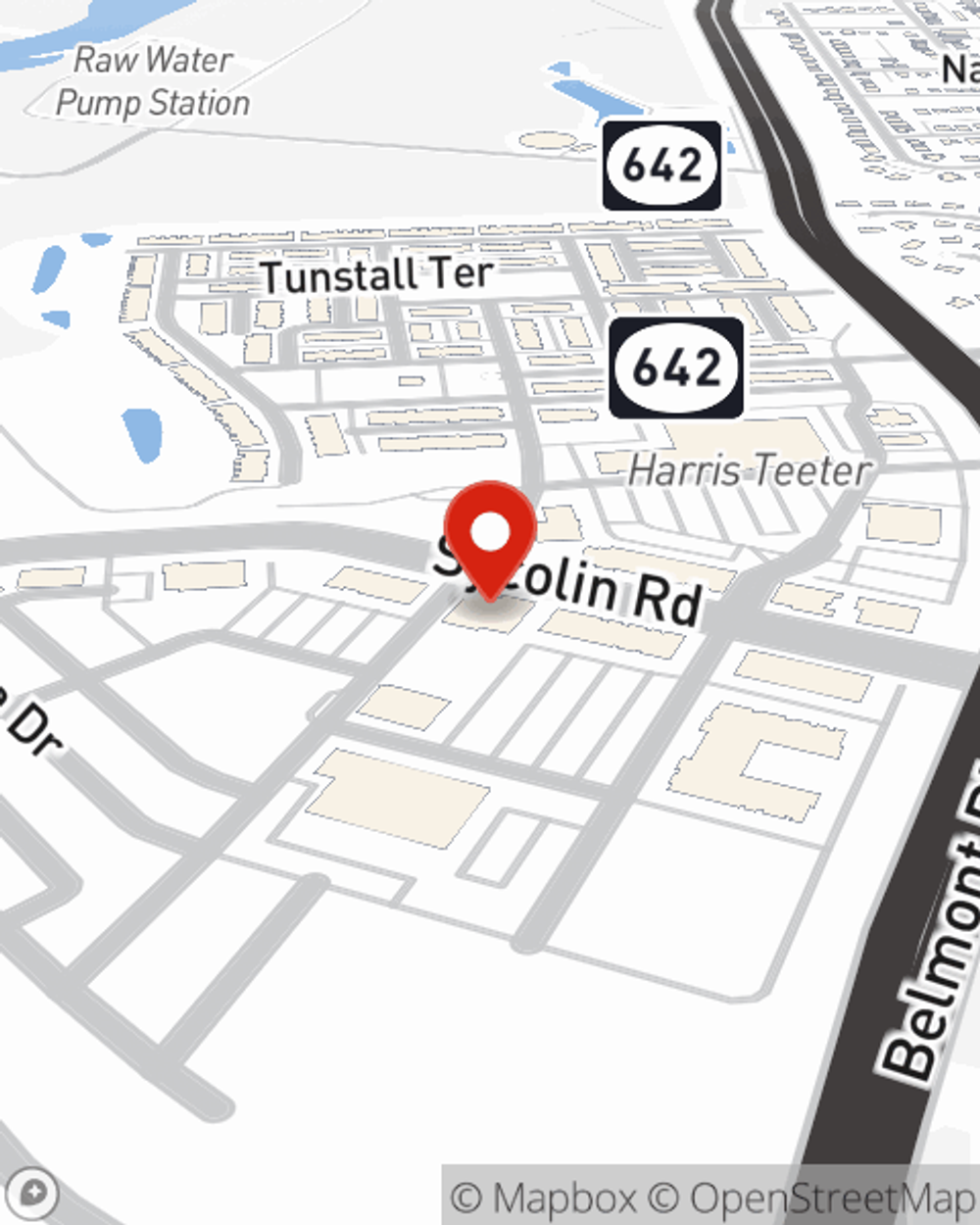

Business Insurance in and around Ashburn

Searching for coverage for your business? Search no further than State Farm agent Pete Smith!

This small business insurance is not risky

Insure The Business You've Built.

It takes courage to start your own business, and it also takes courage to admit when you might need a hand. State Farm is here to help with your business insurance needs. With options like extra liability coverage, worker's compensation for your employees and a surety or fidelity bond, you can take a deep breath knowing that your small business is properly protected.

Searching for coverage for your business? Search no further than State Farm agent Pete Smith!

This small business insurance is not risky

Cover Your Business Assets

When you've put so much personal interest in a small business like yours, whether it's a donut shop, a book store, or a pottery shop, having the right protection for you is important. As a business owner, as well, State Farm agent Pete Smith understands and is happy to offer personalized insurance options to fit your needs.

Get right down to business by visiting agent Pete Smith's team to discuss your options.

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Pete Smith

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.